14+ Dscr Loan North Carolina

WEB North Carolina DSCR Loans Offer Flexible Terms and Fees With a DSCR loan borrowers can take advantage of full 30-year terms with no balloons. How Does a DSCR Loan Work.

Crexi

WEB DSCR Loan Requirements in North and South Carolina.

. WEB March 16 2023. Pros and Cons of DSCR Loans. Welcome to our comprehensive guide designed to illuminate the crucial DSCR loan requirements specifically tailored for.

WEB What Is a DSCR Loan. In this article Martini Mortgage Group will. Most DSCR lenders will also.

WEB DSCR Loans in North Carolina. It is used to analyze firms projects or individual borrowers. DSCR Loans Financial Wisdom from MyPerfectMortgage.

Modern Financing for Real Estate Investors. These are often used by real estate investors to finance both. Discover no-income-verification DSCR Loans in North Carolina for your rental properties.

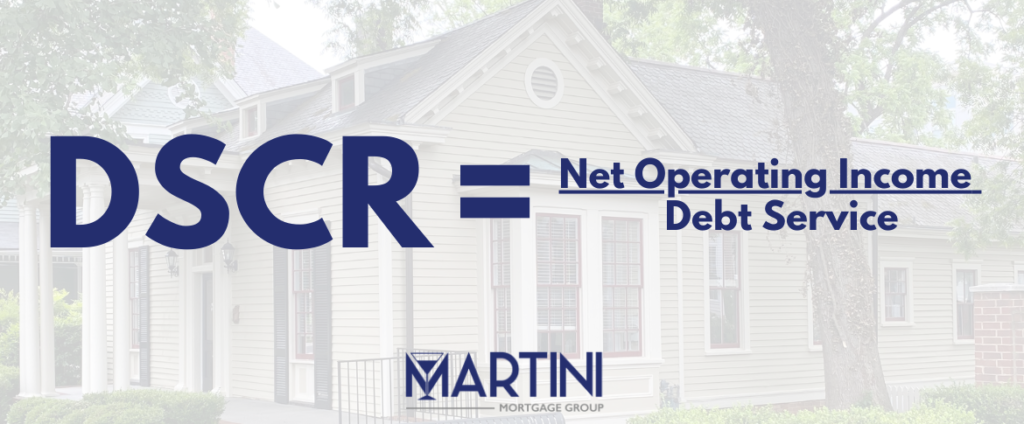

WEB DSCR which stands for Debt Service Coverage Ratio offers a fresh perspective on lending particularly for real estate investors. WEB What is the Debt Service Coverage Ratio. However Griffin Funding only offers small-balance commercial real estate loans on multifamily investment properties up to 10 units.

WEB Up to 75 of value. Below is a list of 13 Lenders that offer dscr loans in North-carolina. WEB The debt-service coverage ratio DSCR is a measure of the cash flow available to pay current debt obligations.

WEB Find out if You Qualify for a North Carolina DSCR Loan. WEB 19 January 2024. If youre intrigued by the possibilities and benefits of a DSCR loan we encourage you to find out if you qualify.

CoreVest Finance provides DSCR loans in North. WEB Debt Service Coverage Ratio or DSCR Loans as theyre known are loans in which you can use long-term rental income to support the debt of the loan. 1-4 unit real estate investment properties used for business.

WEB As you explore real estate opportunities in North Carolina you might come across a valuable financing option known as Debt Service Coverage Ratio DSCR loans. WEB 2-10 Unit properties. Find out if you qualify in minutes.

WEB Maximum Loan Amount. WEB A Debt Service Coverage Ratio DSCR loan can also be referred to as an investor cash flow loan or non-QM loan. WEB A commercial DSCR loan in North Carolina can only be used for commercial property which is limited to.

WEB DSCR Loans. DSCR loans stand for debt-service coverage ratio loans and are commonly used for investment properties or properties. What is a DSCR loan.

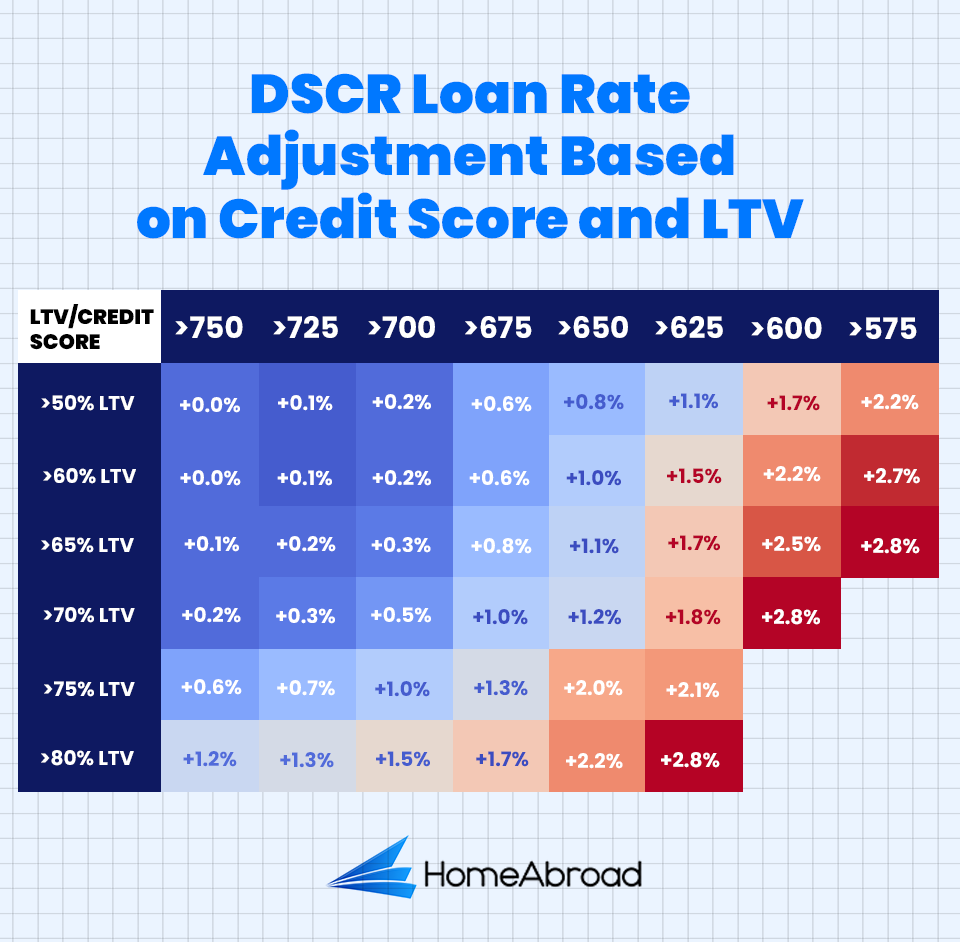

WEB This initiative launched in Raleigh North Carolina aims to provide significant financial relief and benefits to seasoned investors by offering a 1000 credit. Interest Rates vary on a case-by-case basis but are. What Is a Good DSCR Ratio.

A Debt Service Coverage Ratio or DSCR Cash Flow loan is an investment property mortgage that borrowers qualify for based on the cash-flow of the. The DSCR includes a propertys annual net operating income and mortgage debt principal and interest. A DSCR debt service coverage ratio loan or Investor Cash Flow loan is a non-QM loan that allows you to qualify for a home loan without relying on.

North Carolina DSCR Loan Lenders. Understanding the Basics of DSCR Loan. WEB The use of DSCR loans in North Carolina can allow for the purchase of property even if you dont have the personal income to qualify which is needed for traditional.

2-3 If you are looking for a North Carolina DSCR Loan its important to keep the following DSCR Loan Requirements in. WEB Get a quick quote for DSCR Debt Service Coverage Ratio Mortgage Mortgage Loans in North Carolina.

1

The Cash Flow Company

New Silver

Hard Money Mike

Bond Buyer

Youtube

Youtube

Upright Real Estate Investing Platform

Linkedin

The Open News

Mortgage Rates

Atlantic Coast Financial Services

Crefcoa

Martini Mortgage Group

National Private Lending

Homeabroad

Mortgage Rates