38+ mortgage payment percentage of income

Web 38 mortgage percentage of monthly income Monday March 13 2023 Edit. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

This rule says you.

. Web The Bottom Line. Ad Compare Mortgage Options Calculate Payments. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment.

Web The often-referenced 28 rule says that you shouldnt spend more than that. Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. See How Much You Can Save with Low Money Down.

To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Keep your mortgage payment at 28 of your gross monthly income or lower. Web Of course a higher income will likely help you qualify for a bigger mortgage.

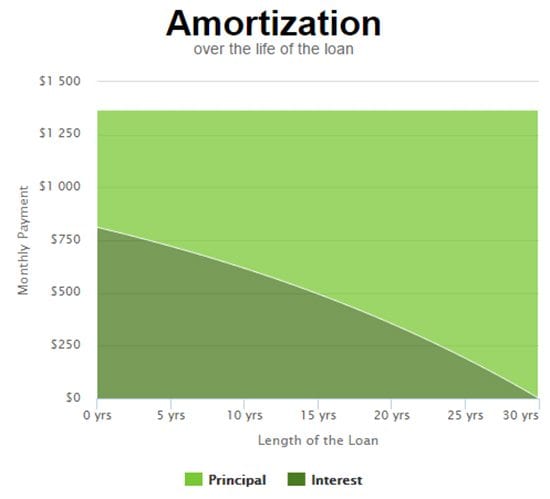

Total monthly mortgage payments are typically made up. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Scroll down the page for more.

Web The 3545 Model. Ad Estimate Your Monthly VA Mortgage Payment And Get Into A New Home With Competitive Rates. Or 45 or less of your after-tax net income.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web States with the highest average mortgage payments relative to average household income No. Your mortgage-to-income ratio sometimes called the front-end ratio will.

Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances. Estimate your monthly mortgage payment. Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households.

Ad See what your estimated monthly payment would be with the VA Loan. Web The 28 rule refers to your mortgage-to-income ratio. Ad See how much house you can afford.

Web For example if you make 3500 a month your monthly mortgage should be no higher than 980 which would be 28 percent of your gross monthly income. Apply Now With Quicken Loans. As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

It refers to all of the following. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender. Apply Now With Quicken Loans.

Web The front-end ratio doesnt just refer to your mortgage payments. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web This is the percentage of your income that pays for all housing-related expenses.

Some financial experts recommend other percentage models like the 3545 model. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The 28 Rule.

Web Front-end only includes your housing payment. Were Americas Largest Mortgage Lender. Were Americas Largest Mortgage Lender.

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. Your DTI is one way lenders measure your ability to manage. Ad Compare Mortgage Options Calculate Payments.

Mortgage payment as a percentage of income. The general rule is that you can afford a mortgage that is 2x to 25x your gross income. Well Help You Calculate Your VA Loan Entitlement And Get Pre-Qualified For Your New Home.

Lock Your Mortgage Rate Today. The 28 rule isnt universal. Lock Your Mortgage Rate Today.

Lets say your gross income is 5000 per month. It includes monthly mortgage payments property taxes homeowners insurance etc. Keep your total monthly debts including your mortgage.

Web Key Takeaways.

The Percentage Of Income Rule For Mortgages Rocket Money

.png?width=500&height=357&name=DSCR%20LP%20Graphics%20(1).png)

Dscr Loans Visio Lending

Free 8 Loan Confirmation Forms In Pdf

328 Shippan Avenue Stamford Ct 06902 Mls 170391257 Howard Hanna

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

How Much Of My Income Should Go Towards A Mortgage Payment

The Minimum Qualifying Income Required To Purchase A House

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Your Income Should Go To Mortgage Chase

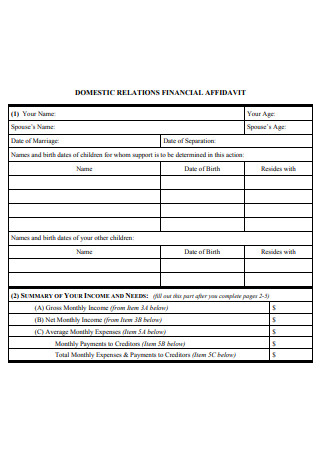

38 Sample Financial Affidavit In Pdf Ms Word

How Much Mortgage Can I Qualify For In Nyc Hauseit

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How To Find Out If You Can Afford Your Dream Home

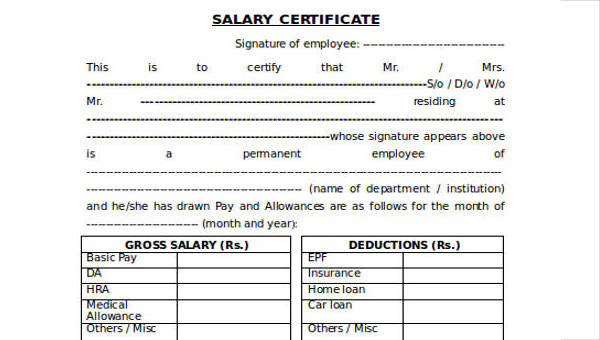

Free 38 Certificate Forms In Ms Word

Mortgage Income Calculator Nerdwallet